CIBIL credit score is a three-digit number ranging from 300 to 900 and it reflects your credit history and repayment behaviour.

What is CIBIL Credit Score?

A higher Cibil credit score (more than 750) gives you better chances for loan and credit card applications, and you can also get lower interest rates. With a lower score (less than 600), you may face difficulty in loan approval and may be charged higher interest rates.

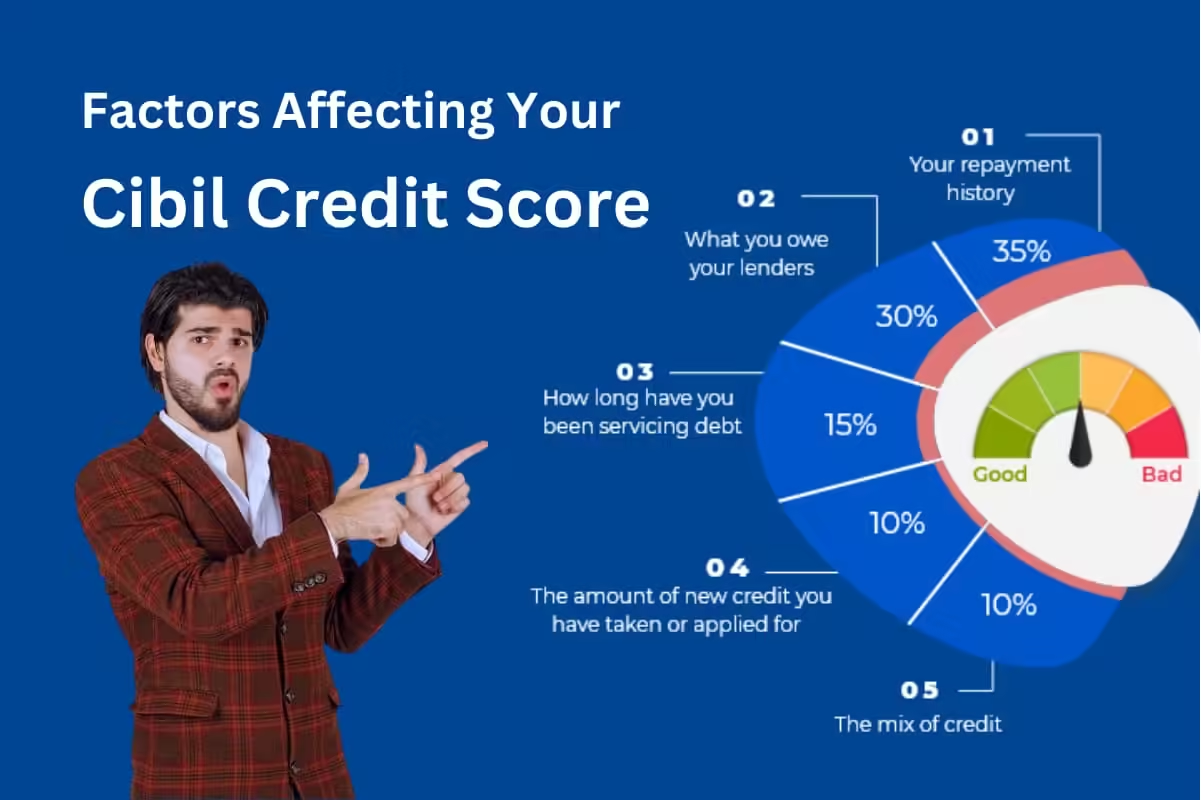

How is the CIBIL Credit Score Calculated?

• Payment History (35%): Time on EMI and credit card payments.

• Credit Utilization (30%): What percentage of the available credit is he getting?

• Credit History Length (15%): How old is your credit history?

• Credit Mix (10%): Mix of secured (like a home loan) or unsecured (like credit card) credit.

• New Credit (10%): Number of new credit applications.

What is the CIBIL Credit Score Report?

CIBIL score and report is an important part of financial health, which reflects your borrowing and repayment habits. Taking good care of it is important for long-term economic benefits.

• Details: The CIBIL report is a detailed document that records your credit accounts, payments, and enquiries.

• Personal Information: Name, Address, PAN, etc.

• Account Information: Loans and credit card details.

• Enquiries: Who checked your credit history and when?

• Employment Information: Job and income details (if available).

You May Like: TRUST WALLET: THE NEXT GENERATION REVOLUTION GATE TO TRADE IN CRYPTO-CURRENCY

How to use CIBIL Score and Report?

• Loan Approvals: Lenders (like banks and MFCCs) assess your repayment ability and risk by looking at your CIBIL score and reports.

• Interest Rates: A higher CIBIL score helps you get lower interest rates and better loan terms.

• Credit Cards: A higher score can get you higher limit and premium credit cards.

• Employment Screening: Sometimes employers check CIBIL reports, especially in financial roles.

How to improve the CIBIL Score?

• Timely Payments: Paying EMI and Credit Card Bills on Time.

• Low Credit Utilization: Minimizing the available credit.

• Old Accounts Maintain: Keeping old credit accounts open.

• New Credit Avoid: Avoiding too many new credit applications.

• Credit Mix: Maintaining a balance of secured and unsecured loans.

How to Check Cibil Credit Report?

- CIBIL Website: You can check your CIBIL report and score by visiting the official website of CIBIL.

- Free Annual Report: As per Reserve Bank of India rules, you can get one free CIBIL report yearly. CIBIL score and report is an important part of financial health, which reflects your borrowing and repayment habits. Taking good care of it is important for long-term economic benefits.

What is the importance of CIBIL?

CIBIL (Credit Information Bureau (India) Limited) The score and report have great importance, as it provides an assessment of your creditworthiness and financial reliability. This directly impacts your loan and credit card approvals, interest rates, and overall financial health. Below are some key points of importance of CIBIL:

1. Loan Approvals:

- Lenders’ Primary Tool: Banks and NBFCs (Non-Banking Financial Companies) depend on CIBIL scores and reports to assess loan applications. Having a higher CIBIL score increases the probability of getting a loan approved.

- Risk Assessment: If you have a low CIBIL score, lenders consider you a high-risk borrower, which puts you at risk of getting your loan application rejected.

2. Interest Rates:

- Lower Interest Rates: A good CIBIL score helps you secure lower interest rates on loans. For example, if your score is above 750, you can get lower interest rates on a personal loan or home loan.

- High Interest Rates: If you have a low CIBIL score, you may have to pay higher interest rates on loans and credit cards.

3. Credit Card Approvals:

- Eligibility: A higher CIBIL score increases your chances of getting premium credit cards and higher credit limits.

- Better Benefits: With a good credit history and score, you can get credit cards with better rewards and benefits.

4. Financial Planning:

- Self-Assessment Tool: With CIBIL score and report, you can assess your financial health and make necessary improvements.

- Long-Term Planning: By maintaining a good CIBIL score, you can be better prepared for future financial goals (like home loans, or car loans).

5. Employment Screening:

- Financial Roles: Some employers, especially for financial roles, check the CIBIL report of candidates to assess their financial reliability and stability.

- Trustworthiness: A good CIBIL score is an indication that you effectively manage your financial responsibilities, which is a plus point for employers.

6. Rental Agreements:

- Tenant Screening: Some landlords also check the CIBIL reports of prospective tenants to assess their rent payment capability and reliability.

7. Insurance Premiums:

- Risk Assessment: Insurance companies can also check the CIBIL report of the applicants to determine their risk profile and insurance premiums.

8. Business Loans:

- Business Financing: If you are an entrepreneur and want to take a business loan, your Personal CIBIL score can also be considered, especially if your business is new and your credit history is not established.

9. Debt Consolidation:

- Better Terms: Having a high CIBIL score can help you get better loan terms for debt consolidation, which can help you replace your existing high-interest debts with lower-interest-rate loans.

10. Financial Stability:

- Credit Management: A good credit score and report an indicators of your financial stability and responsible credit management.

- Future Borrowing: By maintaining a good CIBIL score, you are better positioned for future borrowing needs.

In summary, the CIBIL score and report are an integral part of your overall financial profile. It helps lenders, employers, and other financial institutions assess your financial reliability and borrowing behaviour, which directly impacts your financial decisions and stability.

Where to check free CIBIL Credit Score?

1. CIBIL official website:

- Website: CIBIL Official Website

2. Collaborative Websites of Credit Bureaus:

- Experian India: Experian Credit Report

- CRIF High Mark: CRIF High Mark Report

3. Bank or Financial Institutions:

- Some banks and financial institutions provide free CIBIL scores and reports to their customers. You can check from your bank’s customer service or internet banking portal whether this service is available or not.

4. Mobile Apps:

- Some mobile apps also provide the facility to check CIBIL scores and reports. By downloading these apps and entering your details you can see your score.

Points to Remember:

- Free Annual Report: According to Reserve Bank of India guidelines, you should get a free CIBIL report every year.

- Accuracy Check: Keep checking your CIBIL report at regular intervals and file a dispute for any inaccurate information.

- Security:

- To protect your personal and financial details, check your CIBIL score and report from secure websites and trusted sources.

- By following these steps you can check your CIBIL score and report for free and monitor your financial health.