As Bitcoin dropped to week and a half low by 4% to trade around $15,725.02, according to the Coin Metric and same like that happen with other major cryptocurrencies too, as the impact from the dramatic collapse of FTX continued to ripple through the market.

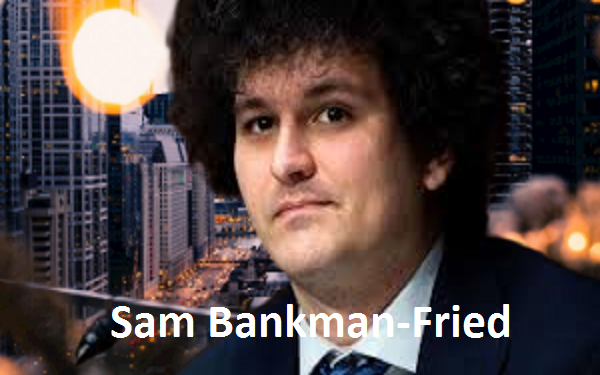

Before his empire crash down in November 2022 Sam Bankman-Fired was one the richest people in crypto world FTX exchange and Almeda Research trading firm. In 2019 he launched FTX and grew it into one of the leading exchanges for baying and selling crypto derivatives. In early 2022 investor of U.S invest $40 billion. His parents was a Stanford law professors, he studied physics at MIT and traded ETFs at a quaint firm before pivoting to crypto trading in late 2017.

His mainly wealth , which he peaked at an estimated $26.5 billion and become a owner of FTX and a share of its FTT tokens.

In the beginning of the November maximum investor withdrawing their investments from FTX at a rapid pace, reason of this Bankman-Fired filled a bankrupt for FTX, FTX`s U.S. and Almeda Research.

Bankman-Fired facing his life very difficult time and The situation has also become such that the possibility of his going to jail has also increased. They are trying everything possible to return the money of the people. Before this happen he donated $40 million to federal campaigns and committees that primarily supported Democrats, according to Federal Election Commission records — including $27 million to a super PAC called Protect Our Future that said it focused on helping candidates. He admitted that he was failed to calculate the situation demand that`s why he reign the CEO position.

Investor Reaction failure of FTX:

Because collapse of the cryptocurrency market as problems at major exchange FTX came to light.

‘Shark Tank’ investor Kevin O’Leary said in an interview with Insider that that FTX, a company he invested in, filed for bankruptcy. He clear his next move he will moving his all assets to Canada and will no longer keep funds in unregulated exchanges.

“I’m writing that all down to zero,” O’Leary told Insider. “It’s not clear what can be recovered. There are a lot of allegations flying around. But frankly, I’ve seen this movie before. It’s a difficult situation, there’s no question about it. There’ll be a mountain of litigation.”

In his view, unregulated exchanges aren’t safe, so that I have started moving my assets elsewhere reason of the company’s collapse rattled trust across the cryptocurrency sector.

Now he turned to crypto exchange WonderFi, which is regulated by the Ontario Securities Exchange. It was the first crypto trading platform on the Toronto stock Exchange and he is a shareholder in the parent company.

“We have confidence that the regulatory environment in Canada scrutinises accounts that can’t be commingled,” O’Leary said. “I can’t find another place on Earth right now safer than Canada.” Because Canada is the only country that offers fully-regulated broker-dealer exchange accounts.

CZ aka Changpeng Zhao Binance CEO also react on FTX situation:

CZ aka Changpeng Zhao Binance CEO will delist three SRM (SRM) trading pairs as the exchange will cease trading SRM/BNB, SRM/BTC and SRM/USDT trading pairs on November 28, according to an announcement on Friday. Because the downtrend continues from the fall of FTX.

More Related to this one can click on this link

Disclaimer: This post is based of research of views which is published on the market and we are not promote or blaming or hurting.